How Much Could Your Next Crisis Cost?

From our colleague and good friend in Australia, Tony Jaques, Director of Issue Outcomes Pty Ltd…

The financial impact of any crisis is high, and new research suggests it will only get higher.

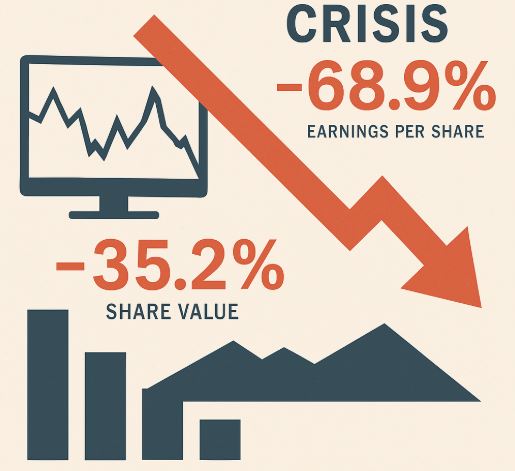

The Crisis 300 index, just released by reputation consultants SenateSHJ, tracks over 300 crises and reveals that share value plummets by an average of 35.2% after a crisis and earnings per share falls by an average of 68.9%.

The new database, which is open for anyone to use, spans companies listed on 27 stock exchanges and 32 industry sectors worldwide over the past 40 years, constantly updated with more recent corporate disasters.

Developed in collaboration with expert data scientists, the index shows that companies took an average of 425 days to regain pre-crisis share values, while 121 of the companies never recovered their previous share value, and 33 of these delisted due to bankruptcy, acquisition or privatisation.

It also reinforced that some industries appear particularly vulnerable to extreme financial impacts in a crisis. For example, the telecommunications sector suffered more than others with share prices plummeting by an average of 64.3%, while the energy sector (55.7%) and banking (37%) were also badly impacted. The banking, financial services and insurance sector endured particularly severe earning per share declines, averaging 106.4%.

While this new index is confined to listed companies, the impact for all organisations is clear. Technically, falling share price is a loss to investors, not the company itself. But when shares collapse after a crisis it’s a massive blow to corporate reputation, as well as having a very real impact on other areas such as financing capacity, performance bonuses, staff recruitment and retention, shareholder and customer loyalty, debt repayment and potential loss of government contracts and brand value. And these are impacts far beyond just listed companies.

The rolling crisis currently involving Tesla, X (formerly Twitter) and Elon Musk is a stark example of the linkage between share value and broader issues of brand, reputation and CEO behaviour. Just the first quarter of 2025 saw Tesla shares fall around 40% and Telsa vehicle sales collapsed around the world. Not to mention Tesla insiders selling 477,228 shares valued at over $160 million.

For the rest, click here.

——————————————

If you like our Crisis Communications Today newsletter, you’ll like Tony’s Issues Outcomes newsletter, too. You can subscribe by going to his website.

Photo Credit: ChatGBT